ASB Bank set out to better engage with its 18–24 year-old customers, a segment that is increasingly looking for easier ways to bank with smarter, simpler, and more intuitive digital experiences. To remain competitive in this segment, ASB needed to rethink its traditional product-led model and evolve toward an experience-led proposition.

As Co-Design Lead, I worked as part of a collaborative team of internal stakeholders and external design partners. In the first phase, research, we uncovered the need for a paradigm shift, moving away from legacy banking structures to a more integrated, human-centred experience that reflects the needs and expectations of the next generation of banking customers.

The design team conducted qualitative research with 18–24-year-olds across New Zealand to uncover deep insights into their banking behaviours and needs. From this rich body of research, four core themes emerged providing the team with a strong foundation for framing design challenges and guiding ideation sprints.

Control – Connection – Joy.

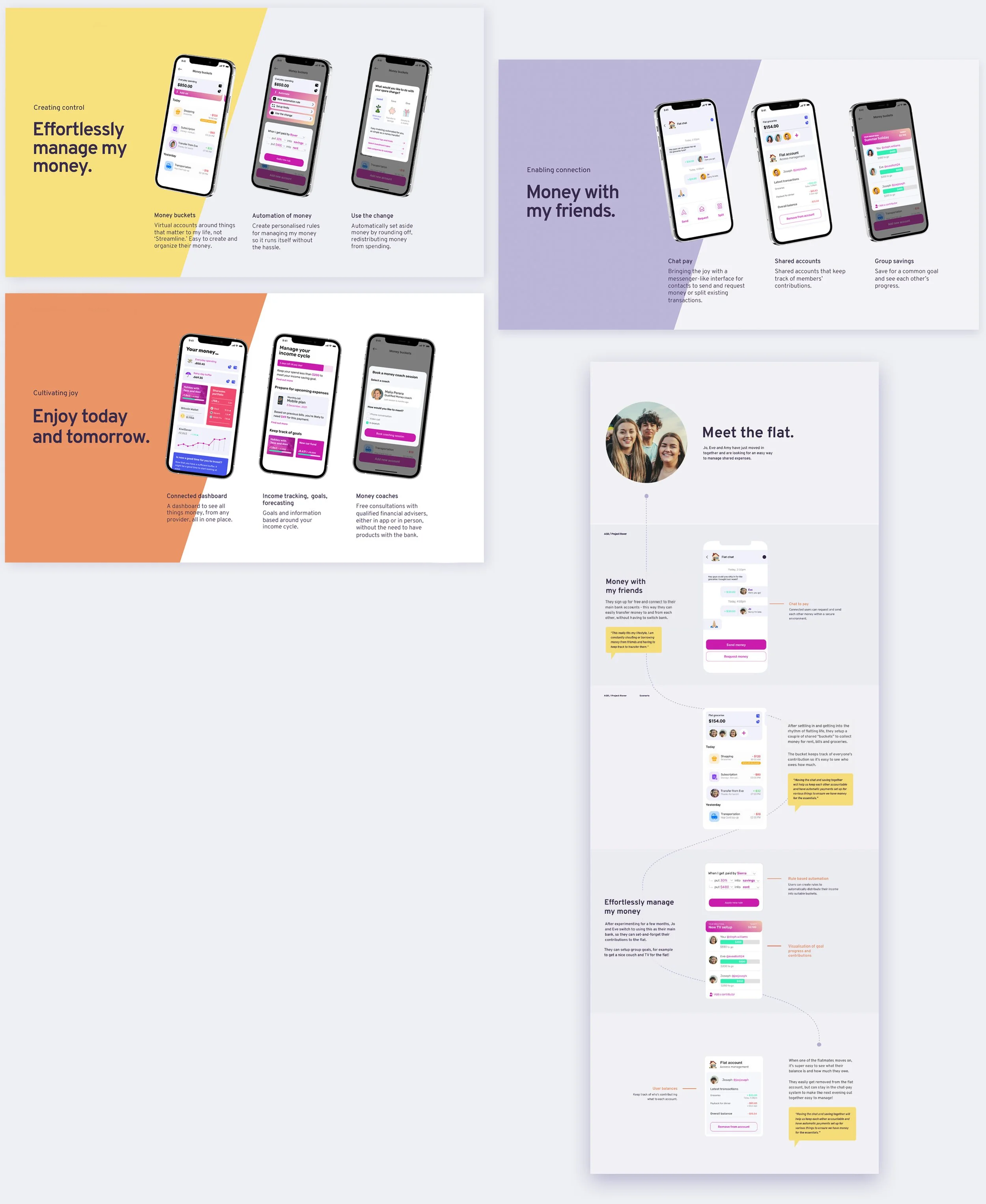

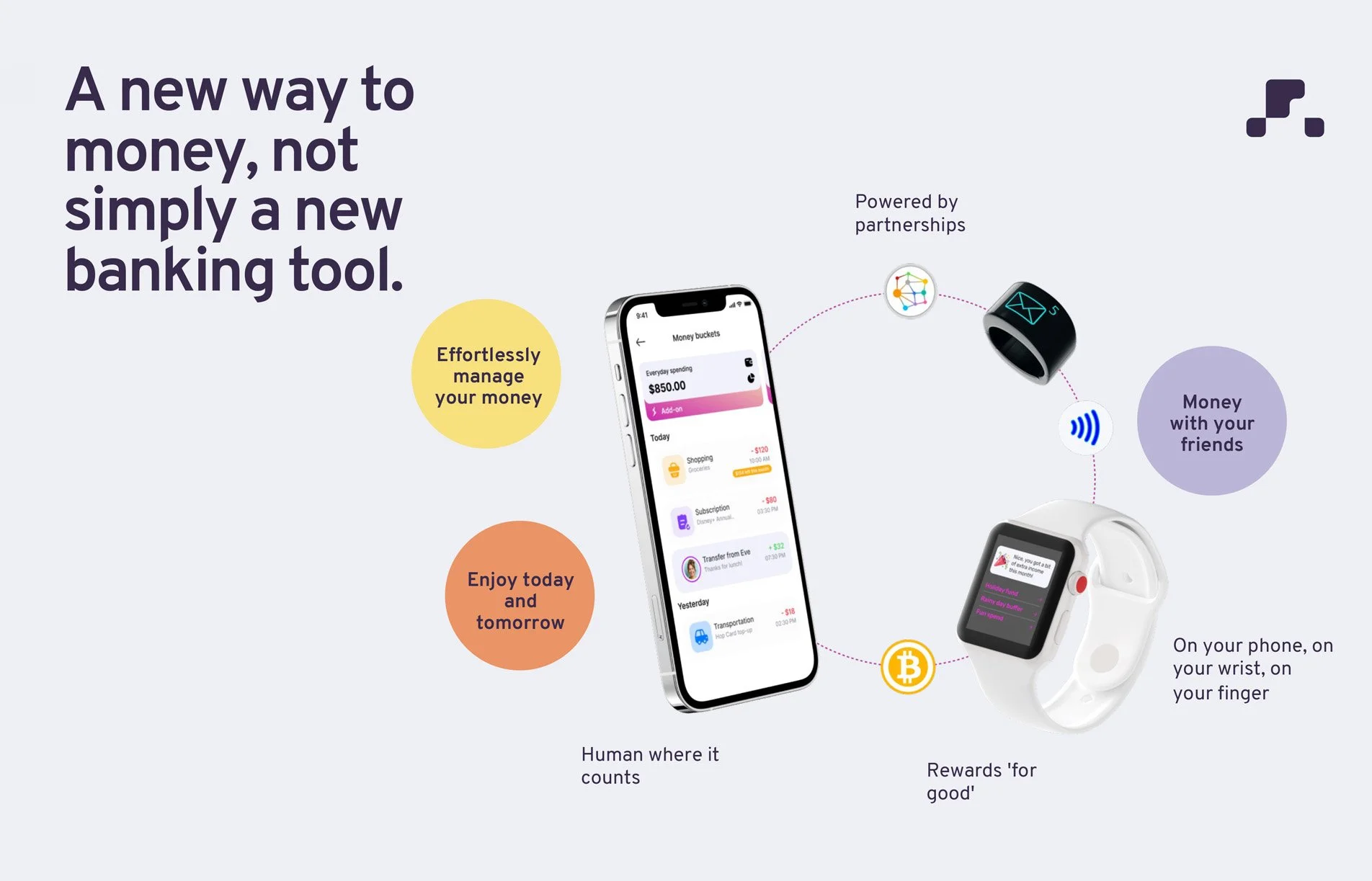

From the problem statements the design team developed three foundational pillars: Control – effortless money management; Connection – money with friends; and Joy – enjoying today while planning for tomorrow. These pillars informed the creation of a clear and customer-centred value proposition to guide the design work forward.

Drawing on the insights from the customer research and developing them in ideation workshops, the team developed an integrated concept aimed at helping 18–24-year-olds manage their banking with ease, while seamlessly connecting to their wider financial ecosystem.

To bring the design concepts to life, three themed digital prototypes and a storyboard were created—each aligned to one of the core pillars: Control, Connection, and Joy. These were tested with the 18–24-year-old cohort and received highly promising feedback, validating the prototypes and their potential to deepen engagement with this cohort.